Community member Paul T has done the math and come up with settlement options that could possibly play out with Next Bridge and the shorts.

Please note this is not financial advice, it is in no way real numbers, speculation only, and for entertainment purposes only.

But we still appreciate the math.

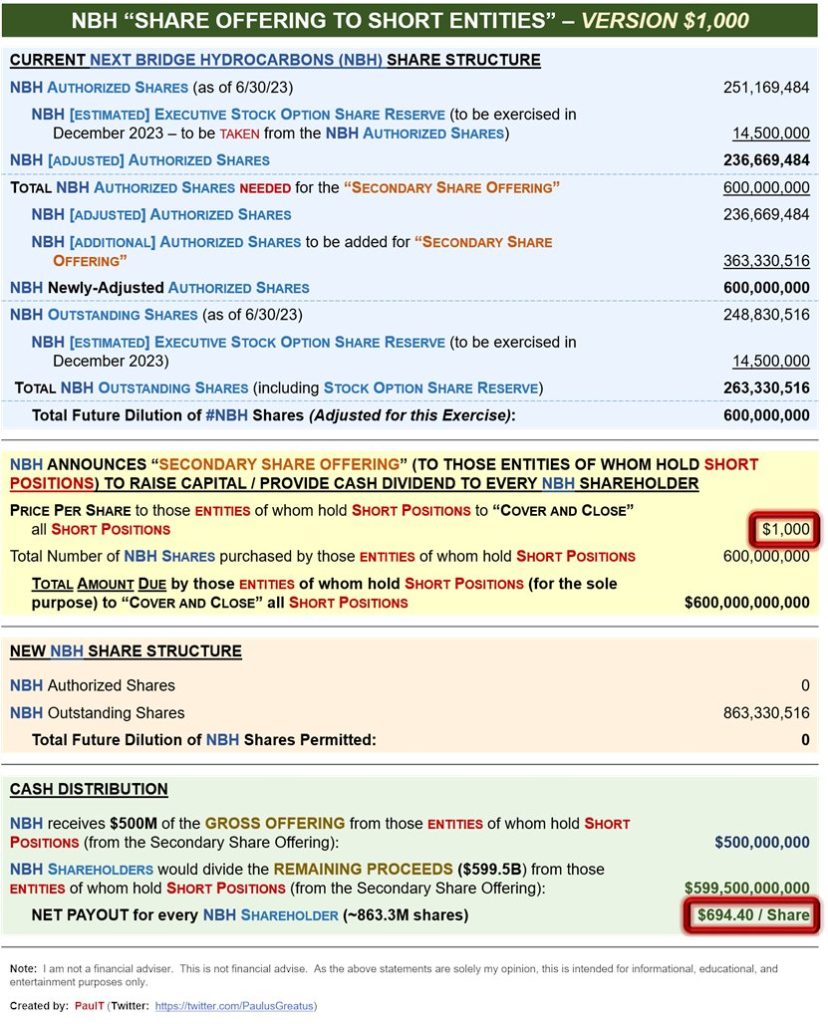

All of these assume the number of counterfeit shares to be 600,000,000.

There are three scenarios requiring short position holders to purchase shares at either $750, $1000, or $1500 from Next Bridge. This is not the payout to the shareholder, it’s a hypothetical scenario where Next Bridge actually negotiates with the short positions and they pay Next Bridge a fixed dollar amount per share.

In short, here is how the numbers work out:

$750 share puchase gives shareholders $520.65 per share

$1000 share purchase gives shareholders $694.40 per share

$1500 share purchase gives shareholders $1041.89 per share.

But the most important and interesting part of this scenario is that we receive these funds for our existing shares and we get to keep our shares and interest in Next Bridge Hydrocarbons. This way, we receive more money when the assets are sold and the dividend is distributed. However, there will be massive dillution to your payout because of the introduction of so many shares. But do you really care? You received a big chunk of money from the settlement!

Thanks Paul T for coming up with another scenario that possibly could occur if negotiations ever opened up.

The documents are available below.

THIS POST IS FOR ENTERTAINMENT PURPOSES ONLY. THESE ARE NOT REAL NUMBERS AND WE ARE NOT AWARE OF ANY SETTLMENT DISCUSSIONS AT THIS TIME.